Artificial Intelligence and Machine Learning are revolutionizing the world. New technologies like Deep Learning are helping FinTech companies design and implement new financial products and services. From B2B to B2C financial companies, this technology has the power to create amazing results when the right data is used.

To make the most out of this HiTech solution, financial companies need to understand its fundamentals and how it can be targeted to improve and test the User Experience (UX). This post addresses what Deep Learning is and how it can be used for FinTech app development through innovative and powerful features.

What is Deep Learning?

Deep Learning (DL) is a powerful HiTech tool used to extract and understand patterns from data through neural networks. This can be done using unstructured data and unsupervised learning — something that was previously hard for computers to do. In brief, unstructured data, like photos, video, audio, and the like, does not have an easily recognizable structure. Because of its characteristics, unstructured data is not easily searchable for computers; thus, it is difficult for software to analyze. Unsupervised learning is a form of Machine Learning that uses a minimum human input to look for patterns in data with no pre-existing labels.

This means that DL algorithms are basically capable of learning on their own without depending too much on human input. As a result, development teams can try to avoid biases that might otherwise pass undetected due to the impact of human-designed algorithms; when writing the code, developers might unintentionally introduce unwanted biases.

One of Deep Learning’s most important uses is task automation through pattern detection. Many hand-engineered features are time-consuming and hard to scale in practice. Thus, DL comes in very handy for a number of industries. For the case of FinTech companies, this translates into the possibility to automate certain key decision-making processes.

The Difference Between Machine Learning and Deep Learning

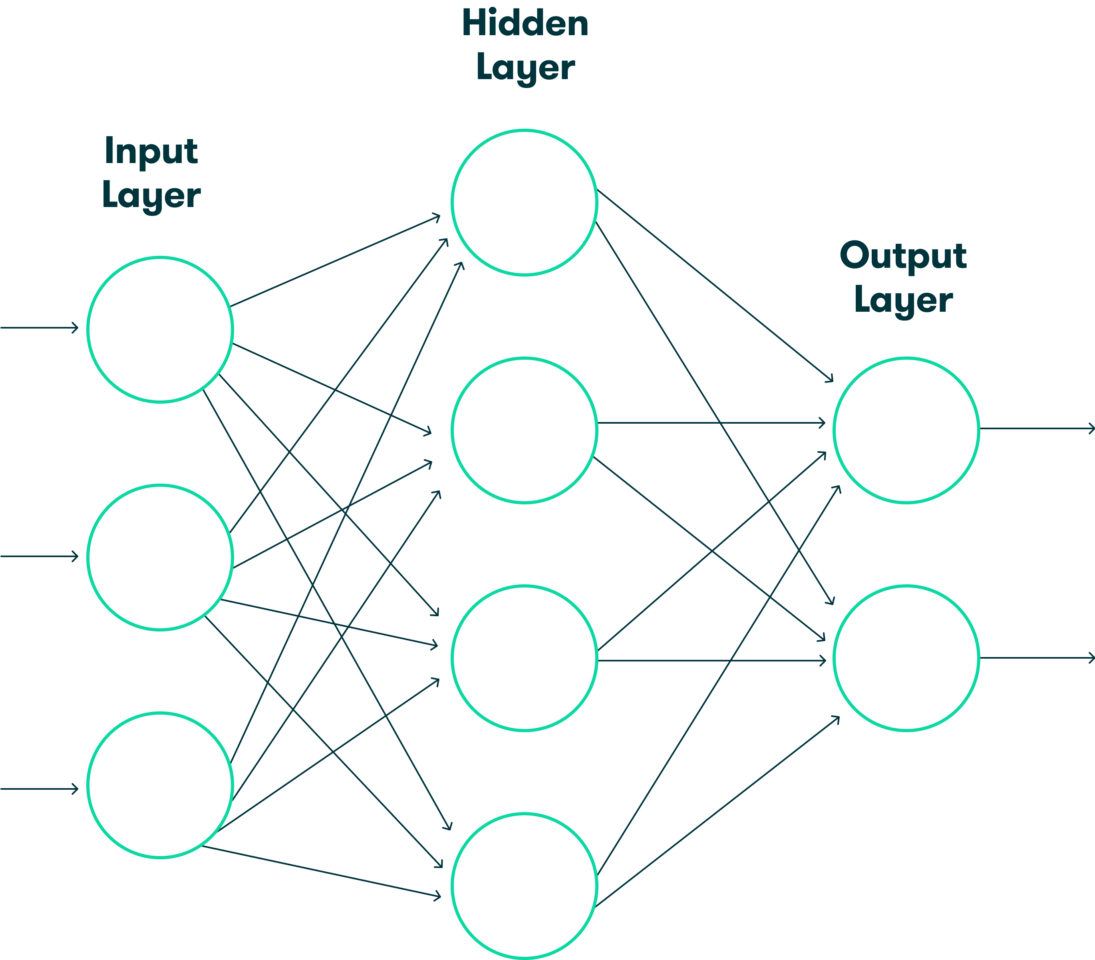

Deep Learning is a form of Artificial Intelligence. More specifically, it is a Machine Learning technique for pattern detection. Currently, most Machine Learning features consist of DL neural networks. Given their similarities, sometimes the differences between these concepts can seem blurry. The most important difference between Machine Learning and Deep Learning lies in the fact that Deep Learning uses layers of algorithms that are referred to as neural networks.

Just like Machine Learning is a subset of Artificial Intelligence, Deep Learning is a subset of Machine Learning. Although other Machine Learning techniques that do not depend on neural networks exist, DL has been widely adopted in recent years. This is in part the result of advances in Big Data, hardware, and software.

Implementing Machine Learning into an app requires having a solid understanding of your data. To do this, it is necessary to have a proper data warehouse as well as a data pipeline. This means setting up properly the cloud configurations for your app. Only by doing so can Machine Learning features work correctly.

Neural Networks and Deep Learning

Neural networks are at the core of Deep Learning algorithms. These are algorithmic techniques that help understand and detect underlying patterns in data; normally, Python is the de-facto programming language used to build them through tools like Tensorflow. Thanks to advances in computing power, developers can work with these tools in ways that were impossible just a few years ago. One of the best things about them is that they are capable of adapting to different data inputs, saving lots of time in terms of updating the code.

Developers often talk of neural networks as dense layers of algorithms and data where all inputs are connected to all outputs. By doing this, it is possible to analyze unstructured data — a task that used to be exclusive to humans. A single block of a neural network is known as a perceptron, which is, in theory, the building block of Deep Learning. The more perceptrons a network has, the more complex it is.

Financial companies tend to have a lot of data regarding customers and operations. By using neural networks, FinTech apps can use their data to automate important time-consuming tasks. More importantly, they can implement cutting edge features that can help improve and test the User Experience (UX).

Deep Learning Applications in FinTech

Most companies looking to implement Deep Learning features into their apps want to know more about industry-specific solutions. Due to the financial industry’s intrinsic characteristics, some DL features work better than others. These are some of the Deep Learning applications and features that you might want to consider in order to improve your FinTech app:

Regulatory Compliance

Regulation is one of the most important aspects of the financial industry. Your app can easily be up-to-date with regulatory requirements by implementing DL-based algorithms. This helps you save time and money throughout your FinTech app’s development process.

Customer Service

Through the use of neural networks, your app will be able to deliver smoother customer support throughout your portfolio of financial services, helping them solve their problems in an effective and efficient way. Interactive tools, like chatbots, are also useful for enhancing customer service and providing better UX.

Customer & Market Analytics

Having the right analytics in place is important to make sense of your data. The best FinTech app developers understand this, and that’s why they focus on building a solid data pipeline that can help improve an app’s overall performance.

Risk Assessment

Defining the risk level of a financial operation can be a hard thing to do. By using DL techniques, your app will be able to help investors quantify risk in a powerful and insightful way. Although it is not a perfect strategy, it does help put things into perspective.

Fraud Detection and Enhanced Security

Cybercrime is on the rise, and financial companies want to make sure that their digital platforms are safeguarded against any potential harm. By implementing DL techniques, your app will be able to detect unusual activity, helping strengthen your app’s security, your customer’s trust in you, and ultimately providing a better User Experience

Identity Management

Technology changes fast, and so do the verification methods embedded in apps. Identity-based security verifies app users via specific credentials and data points. This makes it harder for hackers to bypass your platform’s security.

Investment and Trading Operations

By being able to perform complex calculations, DL can help users make better investment and trading decisions. One of the best things about it is that it can easily recalculate parameters based on real-time information. This helps reduce the time to update your code.

Cost Reduction

As certain tasks become automated throughout your FinTech app development process thanks to DL, you will be able to reduce development time, subsequently lowering your costs. This becomes particularly important once your operations begin to scale.

Improve Processes

Automating certain processes allows you to make better use of your resources, and most importantly, helps you guarantee an optimal level of quality. To ensure your development and IT teams work hand in hand, implement DevOps best practices.

Implementing Deep Learning into Your Fintech App

The first thing to have in mind when implementing Deep Learning into your app is to identify the problem you want to solve. Although there is a wide range of features and solutions that you can use within the FinTech industry, incorporating them all into your app may not be the best solution. Ideally, you first want to determine the specific problem you want to address.

Once identified, you can incrementally improve your neural network rather than updating it all at once. An Agile software development methodology is useful for this, as it helps development teams focus on features in an optimal way without compromising the overall quality of your app’s code.

Finding the right app development partner is essential to make this happen. Most financial companies do not have the specific technical expertise to implement Deep Learning applications using neural networks and customized features. A partner like Koombea can fill in the knowledge gaps to help you ensure that your development workflow goes smoothly, avoiding risks and increasing your productivity. As a result, your FinTech app development process will have a direct impact on the quality of your app.

Contact us for more information if you are thinking about creating a new app or revamping an existing app to start harnessing the power of FinTech and Deep Learning.