FinTech

Koombea: A FinTech App Development Company

Koombea's FinTech application development team competes at a world-class level. We provide our financial sector clients with top-quality money management apps and services, always with a sharp eye on security and intuitive User Experience (UX).

We’re not your typical FinTech app development company. Instead, at Koombea, we pride ourselves on our wide range of design and development expertise. Of course, FinTech software development has a lot of technical requirements. Still, too often, FinTech software development companies will get distracted by these technicalities and fail to deliver an intuitive, user-friendly product.

Using cutting-edge technology and trends, our FinTech app development process will deliver a user-friendly product that keeps engagement high while providing the financial services, efficiency, and safety your business requires.

If you are a FinTech startup or enterprise seeking FinTech software development services, choose an app development company with experience. Koombea’s FinTech app development solutions will drive engagement and delight your users.

We Develop FinTech Apps and Solutions for the Following Categories:

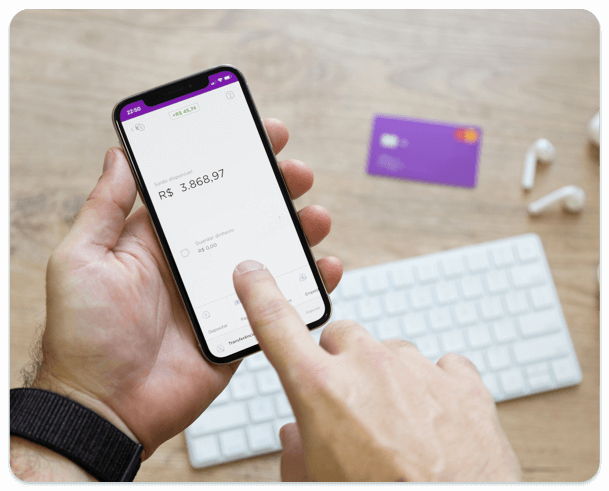

Personal Finance Management

Build personalized and effective money management tools. Help your users access their finances from a secure app that loads in seconds, allowing them to manage their credit cards and checking accounts, all in one place.

Mobile Banks

Mobile banking allows customers to manage their bank accounts remotely from their mobile devices. Our FinTech app development team develops advanced FinTech solutions that help financial institutions generate statements that can be easily downloaded and printed.

Financial institutions that don’t provide a mobile banking option for their customers will lose out to their competitors. Mobile banking is a must for any bank or credit union. If your organization doesn’t already have a mobile banking option, now is the time to develop one for your customers.

Money Transfer

Use our in-depth knowledge to develop flexible app solutions that allow you to send money nationally or abroad instantly and efficiently, at a reasonable value, and with the top global wire providers of your choice. In addition, you can hold and convert money in international currencies with real-time tracking.

Many people in our global economy send money to their family, friends, or business associates abroad. Create a unique FinTech software solution that empowers people to conveniently send and receive money transfers.

Tenant Screening

If you have a property management business, it’s time to invest in an app or software that allows you to create a mobile tenant screening process. It will save you time as you won’t need to have personal meetings anymore. All you will have to do is grab your mobile device and enter prospective tenant data to begin the screening process.

Robo-Advisors

Robo-advisors provide investing tips and guidance, so users don’t have to spend days learning how stocks and auctions work. Implement this feature strategically into your investment app and improve your KPIs.

Smart Contracts

We use smart contract programming codes that are stored and encrypted in the Blockchain system. Through our smart contracts approach, your app will create functionally transparent and automated features for your business.

Smart contracts are automatically executed once the contract terms have been met. These contracts are becoming increasingly more common as they reduce the need for legal representation or mediation. Be a first mover in your industry and implement smart contracts in your financial services.

Finance Management Apps

FinTech apps can help businesses grow by allowing users to create budgets and get better with their savings and finances in general. So whether you want your app to provide a specific budgeting system or one that provides online banking, we'll make sure to provide you with the best technological solutions.

There are several ways to create a stunning FinTech app without transacting or holding user money. Finance management is one of the most popular types of apps on both major app stores because people are always seeking to get a better understanding and more insight into their finances. Additional features such as checking credit scores improve the User Experience and add more value to your FinTech software.

Bitcoin Cash Apps & Cryptocurrency

A cash app is the easiest way to transfer money between friends and family. We build FinTech apps that allow you to buy and sell BTC and other cryptocurrencies directly from a cash app. In addition, we offer advanced cryptocurrency security levels, high-speed transactions, and a variety of functions such as location services, depending on your needs.

Cryptocurrency is more than just a passing fad. There is a lot of interest in cryptocurrency right now, but there is still time to capture the broader public’s attention and educate them on the benefits of crypto. Despite cryptocurrency's popularity and increased visibility, many people still are not sure what it is or how to invest. This provides a major opportunity for forward-thinking businesses.

Mobile Payments

If money transfers are at the core of your business, you'll need an online payment system or payment gateway. We create mobile payment apps for mobile devices such as smartphones and tablets, allowing your users to easily make payments and transfer money.

Mobile payment is an important feature for many users. There are so many simple, easy payment options that users have gotten impatient with waiting. Therefore, if you want to please your users, add mobile payment features to your application.

Stock Price History and Real-Time Tracking

Use your FinTech app for comprehensive time tracking and timesheet management. Your users can track hours, inventories, and bills across projects with our custom applications. You can also use these tools to create stock apps that analyze stock price history data.

We live in a mobile-first world. Today, people want to invest in the market from their smartphones instead of using a computer. Users need real-time price tracking and in-depth historical data to invest and make sound decisions. Create a powerful market tracker and attract a new generation of investors.

Investment Platforms

Unleash your company's full potential with our web and mobile app solutions. Our software designers offer custom UX Design to take your business to a new level. We create stock trading apps, white-label apps, and everything in between and at any level of complexity.

Go beyond stock tracking and give your users the power to invest. As more users take control of their financial futures, interest in investment platforms will only continue to grow. Meet your users where they are and deliver an intuitive, user-friendly experience.

Wealth Management Apps

Help users expand their wealth and track saving options and net worth while comparing exchange rates and the world’s top financial indexes. Wealth management apps are growing in popularity as mobile devices empower more users to take control of their financial futures.

Venture Capital

The venture capital industry is another FinTech trend that is developing in the form of software and apps. At Koombea, we offer the following effective frameworks:

- Opportunity discovery apps

- Networking platforms

- CRMs

- Cap table and Fund management

- Big Data and AI

PCI Compliant Systems

At Koombea, we are committed to PCI compliance. We understand how sensitive your data is and how important security is to the financial industry. Failure to comply with PCI regulations can result in fines, costly data breaches, and loss of user trust. Damage to the reputation of your financial institution can be difficult to repair. So don’t take any chances when it comes to security.

Cybersecurity - Advanced Security Measures

Keep your finance app safe through our cybersecurity approach. We ensure that your data is stored securely, helping your business operate efficiently while reducing risks and cyber threats to your business and users.

FinTech Apps & Machine Learning

Machine Learning is a subset of Artificial Intelligence, and it is a tool we routinely use in financial apps for data analytics. Machine Learning provides apps with the ability to learn without being purposely programmed. We build FinTech ecosystems empowered with Machine Learning as their fundamental technology.

These are some of the most common uses of Machine Learning for FinTech apps:

- Credit scores and bad loans with predictive analytics

- Enhanced financial processing and decision-making

- Fraud disclosure and identity management

- Trading decisions algorithms

Explore Our Blog

Explore Our Blog

The entire Koombea team constantly collaborates to envision the future of the FinTech industry and mobile app development, and we put these insights to work for you. We've compiled our research on our Blog, where you can find quality content about all things mobile tech.

Some of the Brands that Trust Us

Our Focus

App Development for FinTech Startups

Our team understands the challenges faced by early-stage FinTech companies. We’ve built top-ranking apps for a variety of startups. We take a unique approach by fusing traditional and new methods to develop quality apps.

Whether you want to pursue native iOS or Android app development or build a cross-platform app, our team has the expertise to develop a FinTech app that meets your needs. Work with a skilled team that understands the unique challenges FinTech startups face.

Enterprise FinTech App Development

We know how enterprise apps differ from off-the-shelf software. We've customized and launched unique web and mobile financial solutions that meet enterprise-level needs. Our portfolio demonstrates our high-quality standards regardless of the product.

FinTech development needs to match your business objectives and sync with your business processes. Financial companies require FinTech solutions with advanced features and innovative technologies.

Product Planning & Strategy

We offer a full-service product development and strategy team. We dive deep to identify market opportunities, create a long-term mobile strategy, and develop product roadmaps that drive ROI for our clients, which sets us apart from other mobile app development companies.

If you want to create a FinTech app, you must know how these projects differ from typical mobile application development. For example, financial transactions require more security and are subject to more regulations.

Rescue Projects

We specialize in rescuing projects on the verge of failure - Mobile or Web! Combining our qualified experts with a documented FinTech development process, we quickly address underlying development problems, bottlenecks, and performance & usability issues.

Our skilled FinTech developers can help your business change the narrative of your FinTech application and turn your digital banking app into a product that delights your target audience.

Partnerships and Certifications

One of Our Partnerships and Certifications, CAT

One of Our Partnerships and Certifications, Scrum Alliance Certified ScrumMaster

One of Our Partnerships and Certifications, ISTQB

One of Our Partnerships and Certifications, Power Partner

Our Services

Do you want to build a FinTech app? The finance industry is rapidly evolving, and if you want to remain competitive in your target market, you need to offer your customers a convenient way to manage their financial assets. Check out our FinTech app development services and review our technology stack to get your FinTech application development project started.